Beyond UPI: How CBDCs Could Redefine the Future of Money

How digital currency, programmable payments, and cross-border corridors could rewrite the rules of money.

This week on Eximius Echo, we’re tracking a shift at the core of global finance - from payment innovation to programmable money.

As UPI matures and crypto cools, central banks are quietly reimagining money itself. From China’s e-CNY to India’s e₹, the next frontier isn’t faster payments - it’s smarter, sovereign currency.

If you’re new here, Eximius is a Pre-seed VC fund backing bold ideas in Fintech, Consumertech and AI/SaaS. We use this newsletter to share insights, trends, and ideas from the sectors we’re passionate about. Let’s dive in.

What Are CBDCs?

For decades, global finance was defined by centralised systems, i.e. slow cross-border transfers, high transaction fees, and limited financial access for underserved populations. Payments critical to trade and remittances were often costly, opaque, and inefficient.

In 2009, private digital currencies like Bitcoin introduced cryptographic, peer-to-peer alternatives outside traditional banking. But their price volatility, decentralization, and lack of oversight limited mainstream adoption. This pushed central banks to explore a more stable digital alternative, one that combined the efficiency of crypto with the trust of sovereign money. The result: Central Bank Digital Currencies (CBDCs).

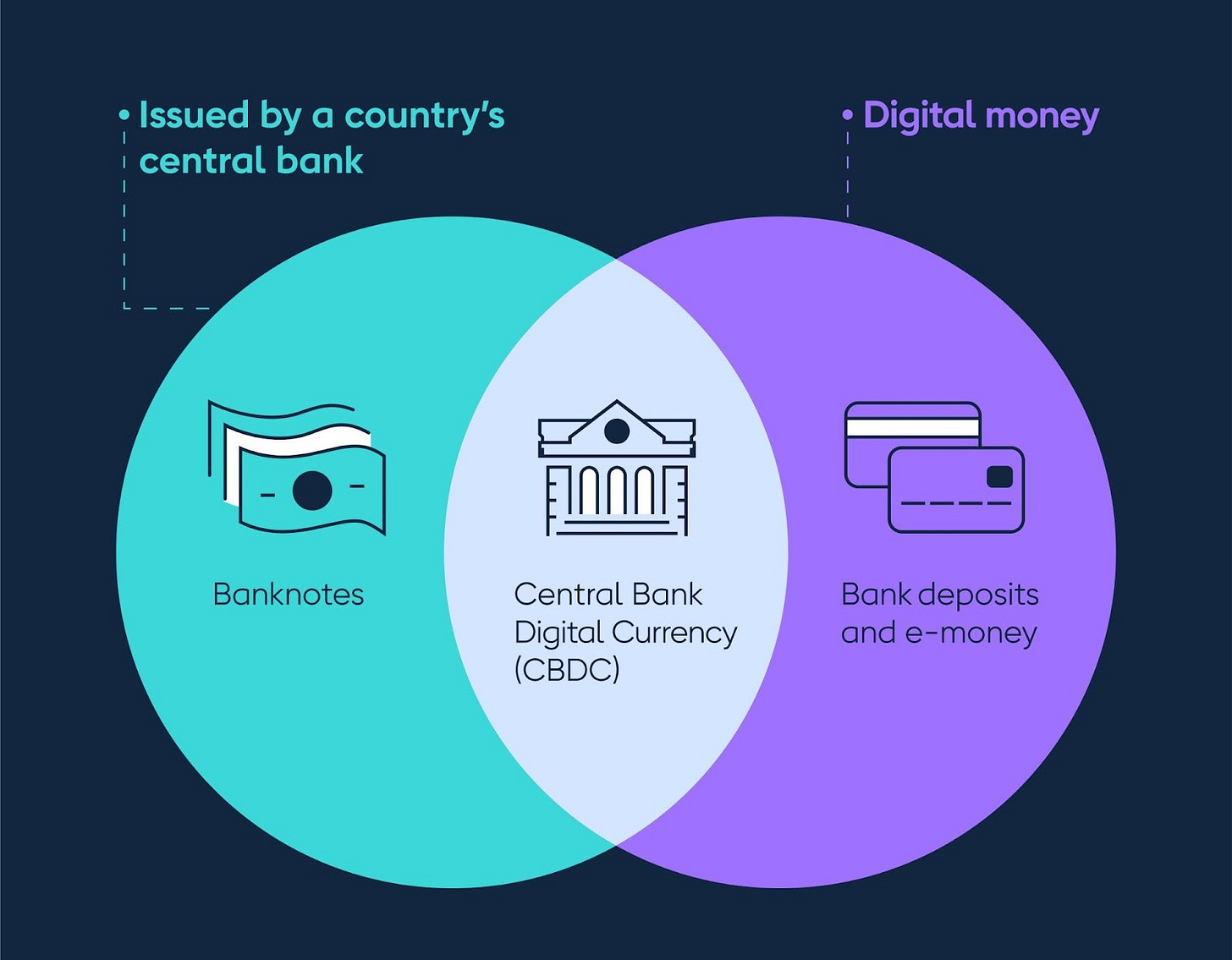

A CBDC is a digital form of a nation’s fiat currency, issued and regulated by its central bank. Like physical cash, it’s backed by the full faith and credit of the government, but exists as programmable, traceable public money.

CBDCs aim to modernise fiat systems by creating a secure, inclusive, and efficient payment layer, serving as both policy tool and infrastructure upgrade for the digital economy. They generally exist in two forms: retail (for individuals and businesses) and wholesale (for interbank and institutional use).

CBDC Under the Hood

So how do CBDCs work? At their core, Central Bank Digital Currencies are built on four key technological pillars:

System Architecture

Defines who issues and manages the CBDC. Most countries follow a hybrid model where the central bank oversees issuance and policy, while commercial banks and fintechs handle wallets, onboarding, and compliance.

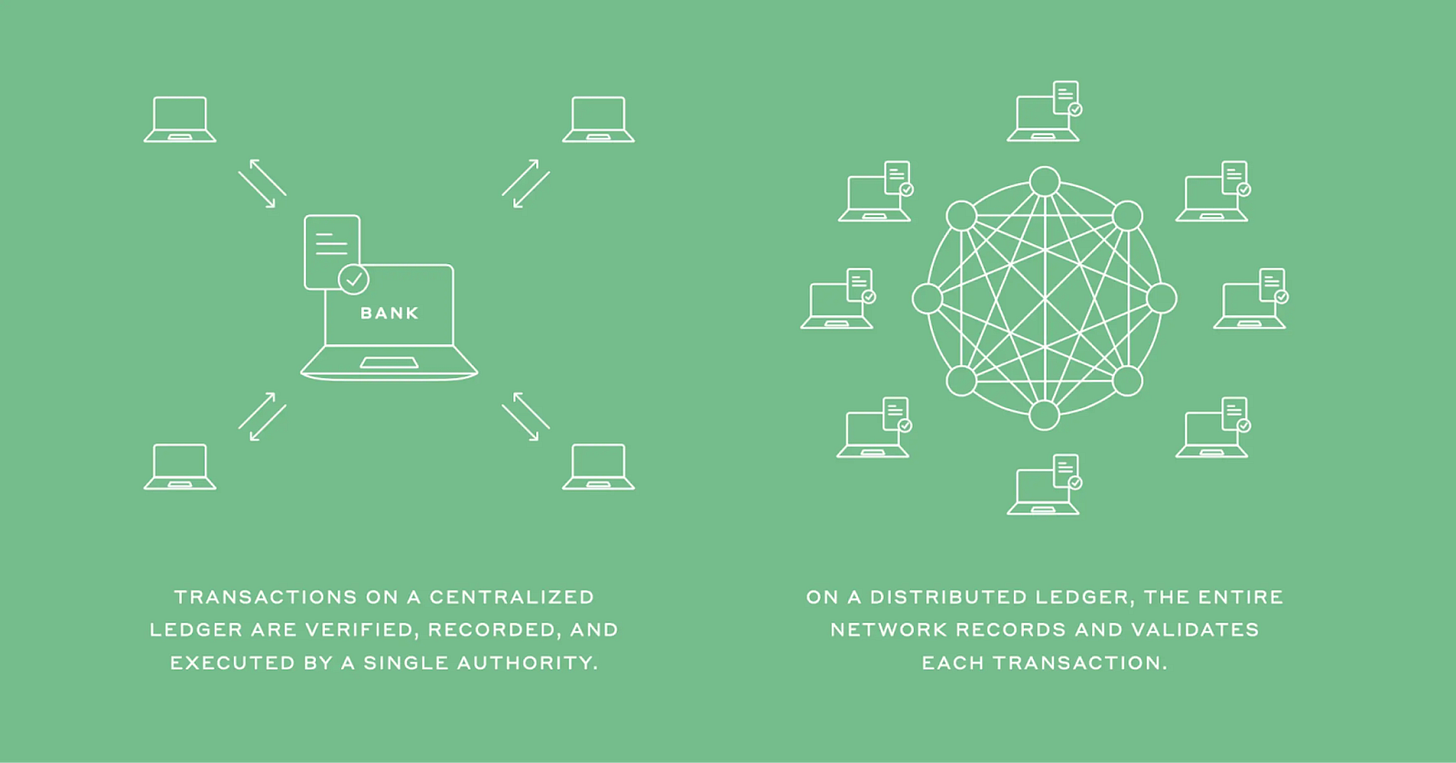

Ledger Technology

All CBDC transactions - creation, transfer, and destruction - are recorded on a ledger, which can be centralized (one authority) or distributed (multiple nodes). Most nations favor Distributed Ledger Technology (DLT) for its transparency, security, and fault tolerance, while some, like China, use a hybrid CLT (Centralized Ledger Technology)-DLT model to balance control with decentralization.

Consensus Protocols

In distributed systems, consensus mechanisms prevent double-spending and ensure all nodes agree on transaction order. CBDCs typically rely on Proof of Authority (PoA) or Practical Byzantine Fault Tolerance (PBFT) for efficiency and security.

Access Models

CBDCs can be account-based (linked to verified identities) or token-based (where possession equals ownership, like cash). Most pilots, including India’s, favor the token-based model, i.e. preserving anonymity and the simplicity of physical money in digital form.

CBDCs Around the World

Developing economies are leading the global CBDC race, using digital currencies to expand inclusion, improve subsidy delivery, and reduce dependence on the U.S. dollar. For these nations, CBDCs represent not just financial innovation but a step toward digital sovereignty and better governance.

China leads with the e-CNY, the world’s largest live CBDC, now at $2.3 billion in circulation (mid-2023) and growing steadily. It’s used for daily retail payments like metro rides and red-packet gifts, integrated into Alipay and WeChat, and expanding into supply-chain finance and programmable B2B settlements. Through Project mBridge, China is also piloting cross-border CBDC settlements with Hong Kong, the UAE, and Thailand, aiming to cut dollar reliance within global trade.

In Africa, Nigeria’s eNaira leads as the first live CBDC, focused on domestic payments and government disbursements, now expanding to remittances and cross-border corridors. Ghana’s e-Cedi targets offline retail use, while South Africa’s Project Khokha explores wholesale CBDCs and cross-border trials (Project Dunbar).

Meanwhile, advanced economies like the U.S. and EU remain cautious; their systems are already efficient and stablecoins like USDC offer digital alternatives without overhauling existing infrastructure.

So where does India stand?

CBDCs in India: The Domestic Push

India’s Central Bank Digital Currency (CBDC) vision is clear - to modernize payments, expand financial inclusion, reduce settlement risk, and enable programmable money for more efficient subsidies and capital markets.

The Reserve Bank of India (RBI) is piloting two variants:

Retail e₹: Enables P2P and P2M payments through bank and fintech wallets, including offline transactions in low-connectivity areas.

Wholesale e₹: Used for interbank settlements and government securities transactions, serving as a regulated digital alternative to cash.

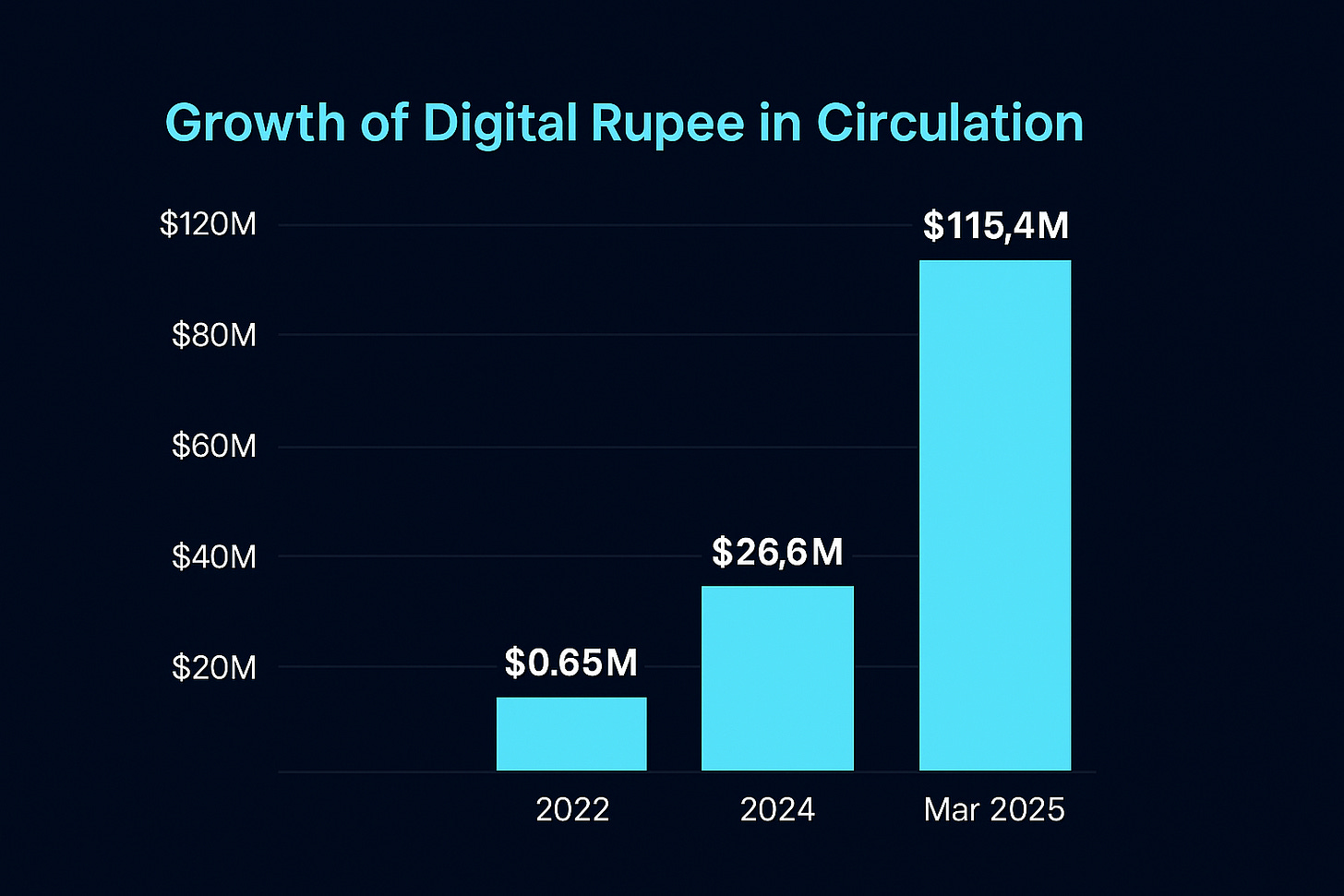

Adoption has risen steadily since the pilot launch in November 2022. Circulation of the digital rupee grew from $0.65M in 2022 to $26.6M in 2024, and $115.4M by March 2025. Today, the pilot includes 17 banks and over six million users, cutting into the $600M annual cash management cost while improving transaction efficiency.

Still, retail adoption remains modest, given UPI’s dominance in P2P and P2M payments. On the wholesale side, banks have formed internal CBDC teams, but few live use cases exist.

A CBDC Sandbox for fintech innovation and testing,

The Unified Markets Interface (UMI) to tokenize assets like bonds and deposits, and

Offline CBDCs to reach the 800 million Indians without internet access.

These moves mark a decisive shift - unlocking opportunities for fintech startups to build India-specific, wholesale-layer CBDC use cases. At Eximius, we’re bullish on this next phase of innovation in digital currency infrastructure.

CBDCs: Benefits and Breakthroughs

Do CBDCs really outperform traditional money systems? Increasingly, yes. By introducing programmable money, CBDCs simplify complex payment processes and unlock new possibilities across trade, governance, and finance.

In bilateral trade, interoperable CBDCs enable countries to settle directly in their own currencies - bypassing SWIFT and the US dollar to reduce costs and delays. China’s Project mBridge leads this shift. Governments are also testing direct disbursements: China has paid salaries and welfare via eCNY, while India is piloting CBDC-based vendor and subsidy transfers.

Another key benefit lies in fraud prevention. Each CBDC unit is securely recorded on a tamper-proof ledger, helping regulators detect fraud, prevent money laundering, and block unauthorised financing - though balancing privacy and traceability will take time.

For businesses, CBDCs offer instant, conditional settlements via smart contracts, an upgrade over legacy systems like RTGS. Much like UPI in 2016, CBDCs are nascent but accelerating fast, poised to redefine how the world transacts and trusts.

CBDCs: The Road Ahead

The next frontier for CBDCs lies in cross-border finance. They could enable instant, low-cost access to global capital by connecting central banks directly. Imagine an Indian company borrowing in China’s eCNY and repaying in digital rupees through a seamless corridor, eliminating intermediaries, FX friction, and settlement delays, while making global capital more accessible.

Beyond this, CBDCs open the door to large-scale tokenization of real-world assets - from deposits and bonds to commodities. With central bank money as the settlement layer, these assets can be issued, traded, and settled instantly, improving liquidity, transparency, and financial inclusion - a key focus for India’s policymakers.

This model combines the efficiency of blockchain with the stability of sovereign money, avoiding the volatility and regulatory uncertainty of crypto.

Meanwhile, smart contracts could automate entire workflows, releasing payments upon delivery, deducting taxes in real-time, and disbursing dividends instantly. For governments, this means greater transparency; for businesses, faster cash flow and reduced friction.

Conclusion

CBDCs were once seen as an experimental technology, a quiet side project to UPI in India and a pilot program in global markets. But growing volatility in the US dollar and a strong push from developing economies to reduce dependence on it, combined with the vast potential of programmable money, have rapidly accelerated global interest and adoption.

In India too, what was once viewed as a step behind UPI has now gained strong institutional backing, marked by the RBI’s endorsement at the Global Fintech Festival.

CBDCs are no longer a concept; they represent the next generation of currency and payments infrastructure. The opportunity now lies with visionary founders to build the solutions and ecosystems that will bring this new financial era to life.

If you are looking to build in this space, we would love to chat! Please reach out to us at pitches@eximiusvc.com.