From Unstructured Story‑Time to Structured Moats: Why Voice‑First, AI‑Native SaaS Will Reshape Early‑Childhood Education

The stories are rich. The data isn’t. In early-childhood SaaS, voice-native capture, pedagogical intelligence, and monetisation layers will turn one-off features into defensible moats.

This week on Eximius Echo, we’re turning the spotlight to a sector that shapes the earliest years of life, and is finally seeing the tech it deserves. Early-childhood education has long run on trust, intuition, and tired teachers juggling paper registers and WhatsApp groups. That’s about to change.

As millennial parents demand deeper visibility and preschools search for smarter ways to scale quality, a new generation of voice-first, AI-native SaaS platforms is emerging, built not on drop-downs, but on dialogue. These tools don’t just digitize attendance and billing; they listen, reason, and scaffold real developmental insight from classroom chaos.

In this edition, we explore how story-time is becoming structured data, why India’s fragmented market is the perfect proving ground, and how the right teams are stacking SaaS, payments, and parent engagement into durable, defensible businesses.

The moat starts with a microphone — and ends with a platform that truly knows your child.

If you’re new here, Eximius is a Pre-seed VC fund backing bold ideas in Fintech, AI/SaaS, and Consumer Tech. We use this newsletter to share insights, trends, and ideas from the sectors we’re passionate about. Let’s dive in.

The Patchwork Present

Walk into a top‑quartile preschool in Delhi or Bengaluru and the tech stack still feels like 2012: WhatsApp blasts for parent updates, Google Sheets for attendance, a paper log for lesson reflections, Zoho/Tally for bookkeeping, and PDF fee receipts languishing in email threads. The result? Teachers lose the equivalent of one full day every fortnight on duplicate entry, and any substitute stepping in mid‑term has to reconstruct weeks of context from scratch.

Across the Pacific, roughly a third of the 130k licensed U.S. centres have upgraded to platforms like Brightwheel, Procare or HiMama. Those systems cover enrolment, daily sheets, attendance, billing and licensing compliance (a huge leap over email), but they were built before LLMs made sense of free‑form media. They choke on the real fabric of an early‑years classroom: bilingual chatter, candid photos, narrative learning stories, and half‑made Play‑Doh dinosaurs. The richest evidence of development stays unstructured, uncaptured, and therefore unmonetised.

Why does that matter? Because parents of toddlers are information‑hungry. They cannot ask a three‑year‑old if she is grasping phonemes or negotiating playground conflicts. The centre that translates messy observation into reassuring insight wins both referrals and pricing power. Today the burden of that translation sits squarely on teachers and administrators. Tomorrow, it will migrate to a new breed of software.

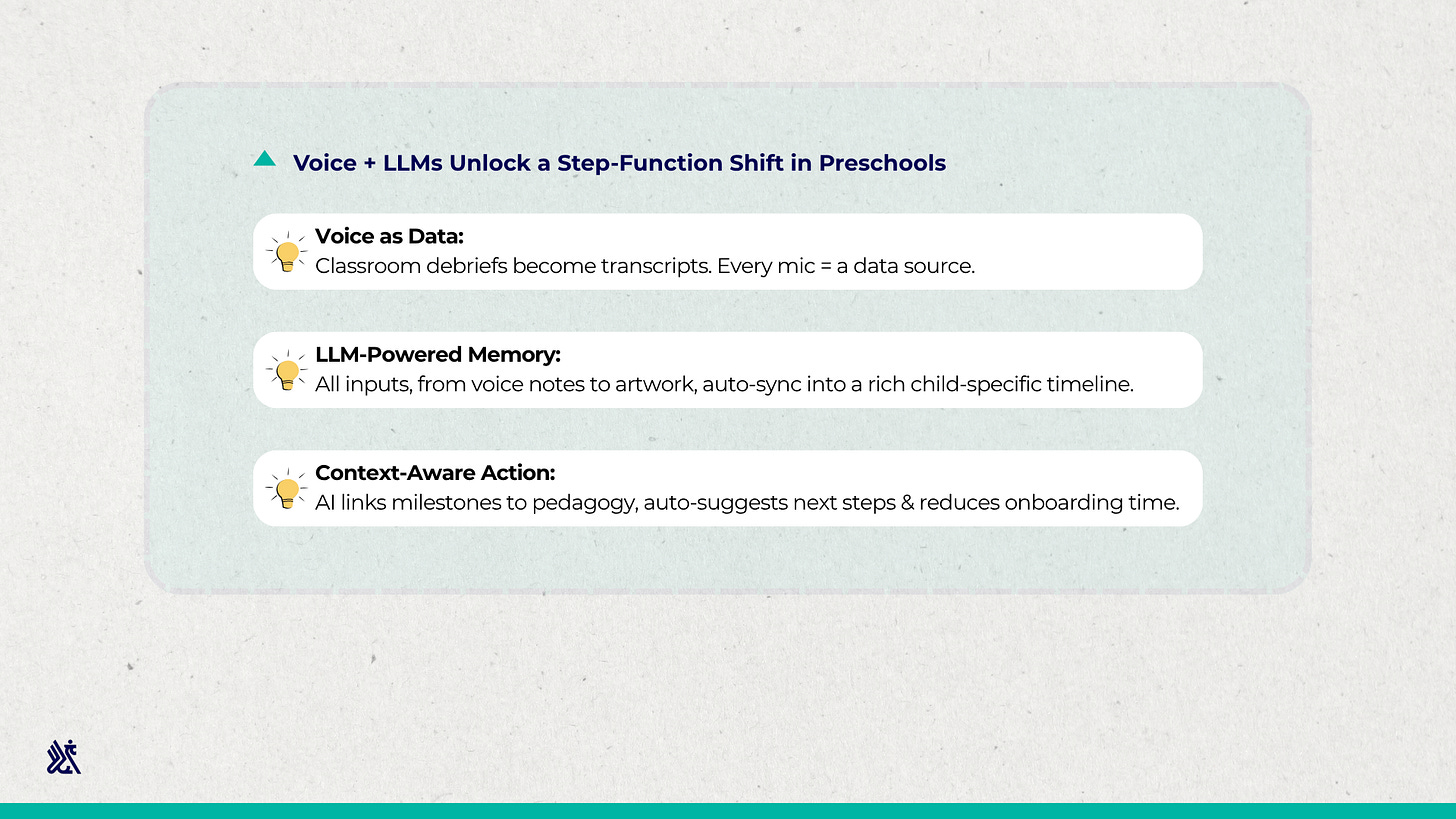

The Step‑Function: Voice + LLMs

Every preschool already generates a prime data source: the end‑of‑day debrief where two educators swap notes - “Advait struggled to match yellow today,” “Dia narrated three pages of The Hungry Caterpillar on her own.” Flip on a microphone during that recap, send the audio to a speech model, and you get a time‑stamped transcript that becomes the foundation of a permanent child record.

LLMs add two capabilities incumbents cannot match:

Seamless capture of unstructured input

All class data - voice notes, photos of block towers, parent messages about pickup changes - flows directly into one date‑stamped dossier per child. Over weeks and months, that dossier morphs into institutional memory, preserving not just daily observations but shared lesson templates, successful activity ideas and best practices. When a veteran teacher leaves, newcomers consult a living archive rather than blank pages, slashing onboarding from weeks to days.Instant, context‑aware reasoning

With a rich timeline in place, the AI maps past milestones and fresh inputs to each centre’s chosen pedagogical framework. It links yesterday’s colour‑naming challenge to today’s tracing exercise, drafts progress summaries and offers precise next‑steps - “Advait shows improving grip strength; introduce eyedropper colour mixing at home.” Rather than forcing teachers to classify every detail by hand, the system interprets raw inputs and delivers targeted guidance, keeping instruction aligned with each child’s unique path.

Best of all, the only hardware needed is the phone teachers already carry. Voice capture happens during existing debriefs or short post‑class recaps; no screens distract children in session, and no one learns new dropdowns. Minimal behaviour change means sales cycles can close in as little as two weeks.

Layer‑Cake Economics: Beyond the Seat Licence

Vertical SaaS often starts as “better back‑office.” The winners evolve into fintech hubs. Early‑childhood SaaS follows the same path:

As scale deepens, exclusive gateway partnerships and instant settlements boost payment margins, shifting the mix toward 50 % fintech revenue, mirroring Toast and Shopify triumphs. Parent‑side upsells remain early‑stage, but a daily 15‑minute habit among millennial families makes that optionality impossible to ignore.

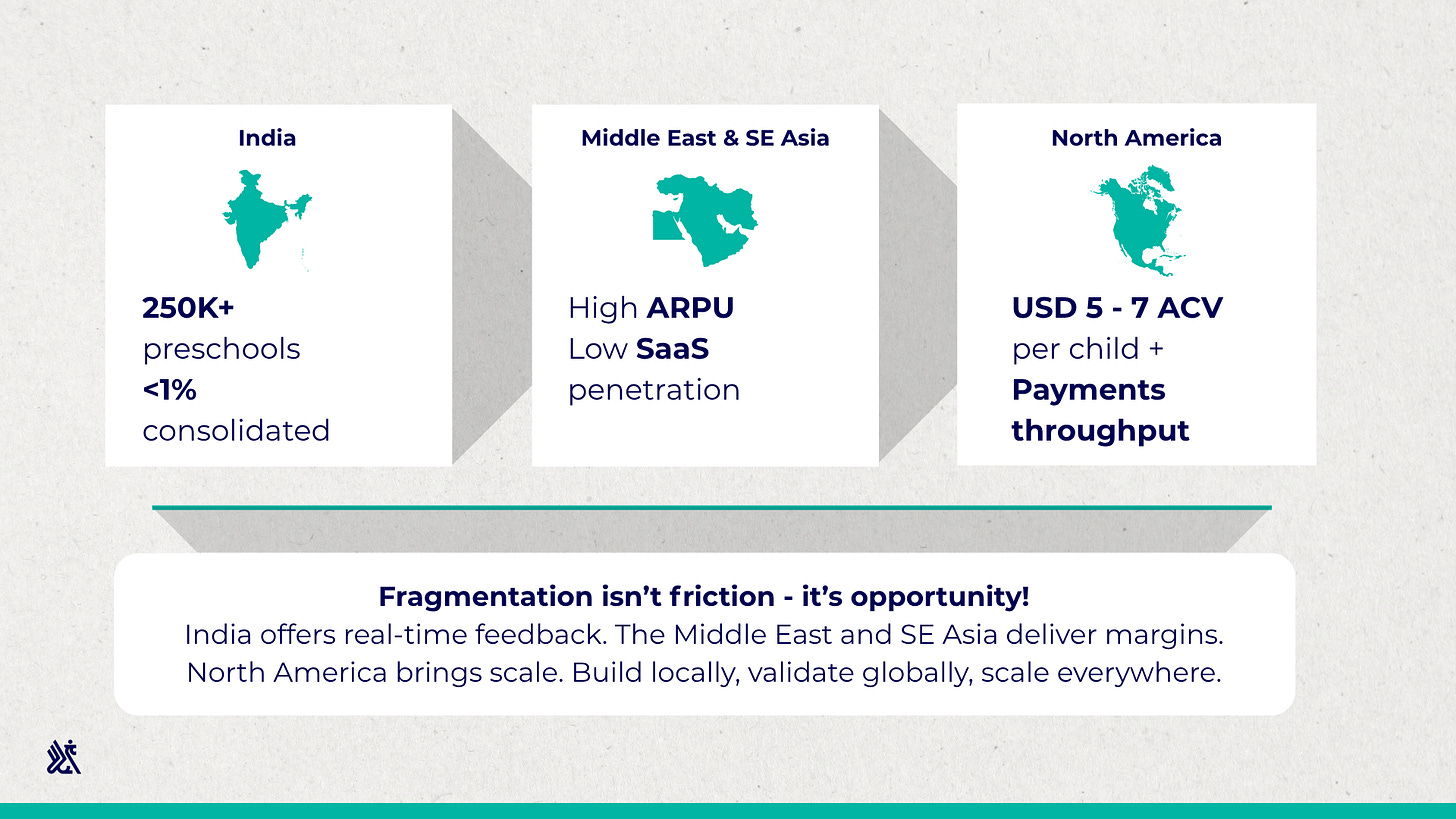

Choosing the Arena: India First, Global Always

Early‑childhood markets everywhere are fragmented - the four largest US chains (Primrose, Kindercare, Goddard, Bright Horizons) together run <4 % of supply; India’s top five chains manage <1 % of an estimated 250 000 centres.

Fragmentation is usually painful; here it’s your wedge:

India | Green‑field. One decision‑maker wears owner, payer and daily user hats. Sales close in 2–8 weeks, CAC is often the founder’s travel bill, and product iteration cycles are measured in days. ACVs are lower, but design feedback is instant. And India’s inherent diversity i.e., dozens of languages, pedagogical philosophies, urban/rural nuances - makes it the ideal proving ground for a platform that must scale globally.

Middle East & SE Asia | Fragmented + Affluent. Tuition rivals the US, English proficiency keeps localisation cheap, and operators lack entrenched software. Early pilots show centres converting inside a month once voice demos surface time‑saved.

North America | Late‑majority, high‑ARPU. Incumbents own contracts, so entry demands a 10x teacher experience and a frictionless migration policy. The payoff is ACV in the $5‑7 per‑child range and massive payments throughput.

What We Look For

AI-first architecture. Data in preschools is not only unstructured, it isn’t captured. You can’t retrofit decades of dropdowns to voice-native capture; you must build from scratch. The winning stacks are those that treat every classroom mic as a data-ingest endpoint, orchestrate multiple LLM and speech models under tuned latency budgets (< 500 ms), and provide editable prompt libraries.

Proof in hard metrics. Show concrete deltas: hours of admin eliminated, assessment completion rates lifted, churn reduced; not emoji counts or anecdotal praise.

Layer‑cake readiness. Payments rails live by Series A, parent‑side monetisation experiments by Series B. If the financial model still leans 80% on seat licences after five years, the TAM story doesn’t hold.

Pedagogy × ML founder‑market fit. The best teams pair deep early‑childhood insight with engineering that respects classroom realities (for example, phones stay pocketed during sessions; debrief corners are fair game).

Closing

Early‑childhood education will not pause for decades‑old incumbents to refactor their monoliths. It will leapfrog from WhatsApp chatter and paper registers to voice‑first agents that structure data the moment class ends. The platforms that capture that narrative, extract insight and layer on payments and parent‑value will claim the wedge in a market that (unlike K‑12) still lacks a dominant operating system.

Parents may never notice the heavy lifting of LLM orchestration under the hood; they’ll only feel that the centre truly “knows” their child. In a business where one delighted parent brings two more through the door, that is as powerful as any P&L line item.

For investors, the blend of fast sales motion, compounding fintech layers and a data moat that thickens with each conversation echoes the best vertical SaaS success stories of the last decade. We’re watching closely. You should too.

If you are looking to build in this space, we would love to chat! Please reach out to us at pitches@eximiusvc.com.