Is Middle East the Next Biggest Market for Indian Games?

Exploring the opportunities and challenges for Indian gaming studios in a shared cultural landscape

Hi there!

This week on Eximius Echo, we discuss how India's gaming industry is booming, attracting skilled developers and big investments globally. We dig deeper into the Middle East gaming market, which shares many similarities with India, offering a promising opportunity for Indian game makers.

If you’ve not heard of us, Eximius is a sector-differentiated fund focusing on FinTech, SaaS, Media & Gaming, and HealthTech. You can find out more here. This newsletter is an attempt to share ideas, insights, and context within the realms of our chosen sectors. Let’s dive in.

The Indian gaming industry has undergone a one-of-a-kind renaissance over the past few years. With an influx of veteran developers who’ve honed their craft at international studios and a rising investor appetite (over $2.5 billion invested over the past three years), we see a multitude of new studios looking to build games for the Indian audience. Interestingly, while the vast majority of supply is now focussed on honing into Indian themes, quite a few developers are also looking to build from India, for the world. While this strategy necessitates world-class execution capabilities, it is perhaps more important for developers to identify areas ripe with opportunity and answer the pressing question of their target market. Faced with saturated markets in Tier-1 West, quite a few developers are now looking at a new market as the promised land - the Middle East.

While the Middle East is the fastest-growing region in the world, there are a few interesting quirks at play that make it even more enticing for Indian game developers. But, before we dig deeper, let’s understand the market.

Overview of the MENA Market

The MENA region is home to three main gaming markets - Saudi Arabia, UAE, and Egypt.

Saudi Arabia commands the largest share in revenue with 57.6% despite having only a third of the region's cumulative player base due to the audience's high-paying capacity. However, the gaming industry in Saudi Arabia is quite dependent on foreign publishers from established countries like China and the USA which cumulatively receive over 56% of the revenue generated in the country.

The UAE market is quite similar in terms of player behaviour to Saudi Arabia. However, its domestic publishing industry is more robust than most of its peers. While China and the USA together receive ~60% of the revenue in the UAE, the domestic industry is third in the tally with a share of 5.8%.

The third largest market is Egypt which commands over half of the player base, but its revenue share is only 1/10th of MENA’s. Therefore, while it serves as an interesting market for garnering DAUs and testing early traction, it’s difficult to command significant revenue from Egypt.

Growing Mobile Gaming Player Base

Similar to India, the MENA market is also in a rather nascent stage as demonstrated by the two factors below:

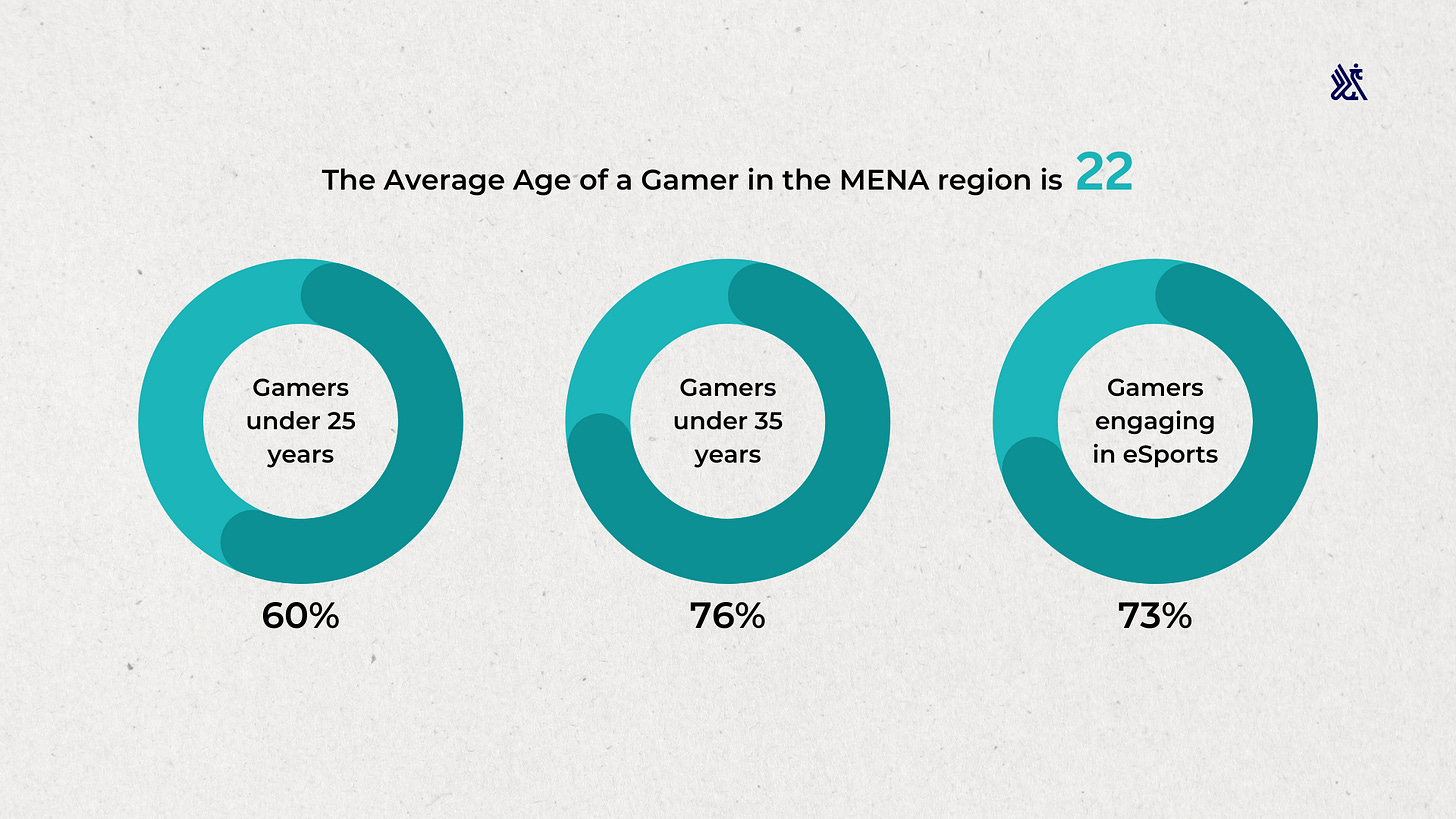

a) Audience Demographic: Home to 68.4 million gamers, MENA presents a young market for developers with 60% gamers under the age of 25. This is also the fastest growing gamer base in the world with increasing gender equity. As per a study by Niko Partners, women represent 32.7% of the gamer base in MENA-3 (Saudi Arabia, UAE, and Egypt). While this is lower than in other major regions like Asia, this ratio is expected to improve in the coming years.

b) Consumption Patterns: As is expected of a young gamer base, smartphones form the preferred gaming medium in MENA with 65% of the revenue coming from these devices. This market engages with games in the form of ardent content consumption as well. 73% of MENA gamers engage with eSports. Moreover, the MENA streaming market is growing at a ~25% CAGR till 2025 which is 3x the growth rate of China (the largest streaming market). These gamers also interact with games with greater intensity. The daily session count in these markets is particularly impressive with 2022 peaking at over 40 sessions daily for the top 2% of the games. The ARPPU for the same set of games during the same period was consistently over $60 and peaked at ~$75. Saudi Arabia, in particular, has a high-paying audience with an ARPU that exceeds their closest competitor in MENA by ~3x ($283.7 as per Deloitte).

Unique Cultural Overlap with India

MENA is an attractive market for gaming studios due to a young gamer base with a high-paying capacity and a behaviour pattern very similar to India. This forms a unique opportunity for Indian gaming studios.

A very prominent point of similarity with the Indian gamer base is their genre preferences. Out of the five highest customer-spend receiving genres in the region, four were the same as in India (shooting, strategy, casino, and RPG). These four genres in addition to tabletop games cumulatively generated over $1.2 billion in IAP spending. Both India and MENA are in love with shooters. Out of the three most played IPs in MENA (played by two-thirds of the gamer base), two are shooters – PUBG and Call of Duty. Shooters are also the highest customer-spend-receiving genre in India.

MENA’s love for tabletop games specifically is quite notable. This genre includes games like Yalla Ludo and Ludo Star. The latter, which is making $2 million every month (as per SensorTower), is in fact from an Indian studio – Gameberry. 51% of Ludo Star’s lifetime revenue has come from Saudi Arabia and another 11% from UAE. Ludo happens to be an important cultural commodity in India with the game being derived from Pachisi which was created in the 6th century.

Therefore, alongside having a user base akin to India in terms of demographics and consumption patterns, there is also considerable overlap in terms of content preferences between MENA and India.

Summarising the Indian Opportunity

While the MENA market is quite similar to India in terms of age profile, customer behaviour, and gaming content preferences, the player base has much higher disposable income which adds to its value for the Indian ecosystem, in particular. However, the administration’s aggressive investment intent to establish a local ecosystem (Saudi Arabia has set aside $38 billion to develop gaming studios) could considerably increase the competition in those markets for foreign developers.

Hence, for Indian studios looking to enter the Middle East, there are considerable advantages from cultural overlaps, but the pace of execution will be a big factor in being able to win in these markets

If you're venturing into Gaming or have innovative ideas in this space, we're eager to hear from you. Reach out to us at pitches@eximiusvc.com.