Physical AI and Its Role in Shaping Industry 5.0

Industry 5.0 builds on Industry 4.0 by emphasising human-machine collaboration, sustainability, resilience, and personalisation.

Hi there!

This week on Eximius Echo, we explore a quiet but profound transformation unfolding across the physical world: the rise of Physical AI - where intelligence is no longer just digital, but embodied. Once relegated to industrial labs and sci-fi visions, robots that see, learn, move, and collaborate are now stepping into real-world roles - from warehouse floors to hospital wards, and city streets to space stations.

Backed by billions in venture capital and spurred by breakthroughs in generative AI, edge computing, and advanced simulation, Physical AI is shifting from experimental novelty to industrial inevitability. Its impact is not theoretical - it’s operational, already reshaping the global economy and pushing us toward the promise of Industry 5.0, where machines don’t just automate tasks but augment human potential.

If you’re new here, Eximius is a pre-seed VC fund backing bold ideas in fintech, AI/SaaS, and consumer tech. We use this newsletter to share insights, trends, and ideas from the sectors we’re passionate about. Let’s dive in.

What is Physical AI, How Big Is It, and Why Now?

The world is witnessing the dawn of a new technological paradigm, one where artificial intelligence is no longer confined to digital domains but is embodied within machines capable of interacting with the physical world in real-time. Physical AI, by merging cognitive capabilities with mechanical motion, represents the next frontier in automation and intelligence. This shift marks a departure from static, rule-based systems to adaptable agents that learn, perceive, and operate seamlessly alongside humans.

The impact is already measurable: the global Physical AI market stands at USD 72.6 billion and is projected to more than double by 2030, reaching USD 166 billion with a robust CAGR of 16.4%. This momentum is fuelled by demand for intelligent automation across manufacturing, healthcare, logistics, and beyond. This transformation has not gone unnoticed by investors. Over the past decade, more than USD 100 billion has been directed toward robotics startups, where 2024 funding had seen almost USD 12 billion, a 40% jump over the previous year.

Two core trends are driving this uptick. First, the disruption of the infrastructure layer, long stagnant, is now underway, catalyzed by the introduction of GenAI-powered development tools and simulation platforms. Second, cognitive robots are proving capable of tackling complex, multi-domain tasks while reducing cost and increasing reliability. These systems are particularly effective in high-demand, data-rich environments such as retail, delivery, and sanitation, and their performance is drawing both capital and commercial interest.

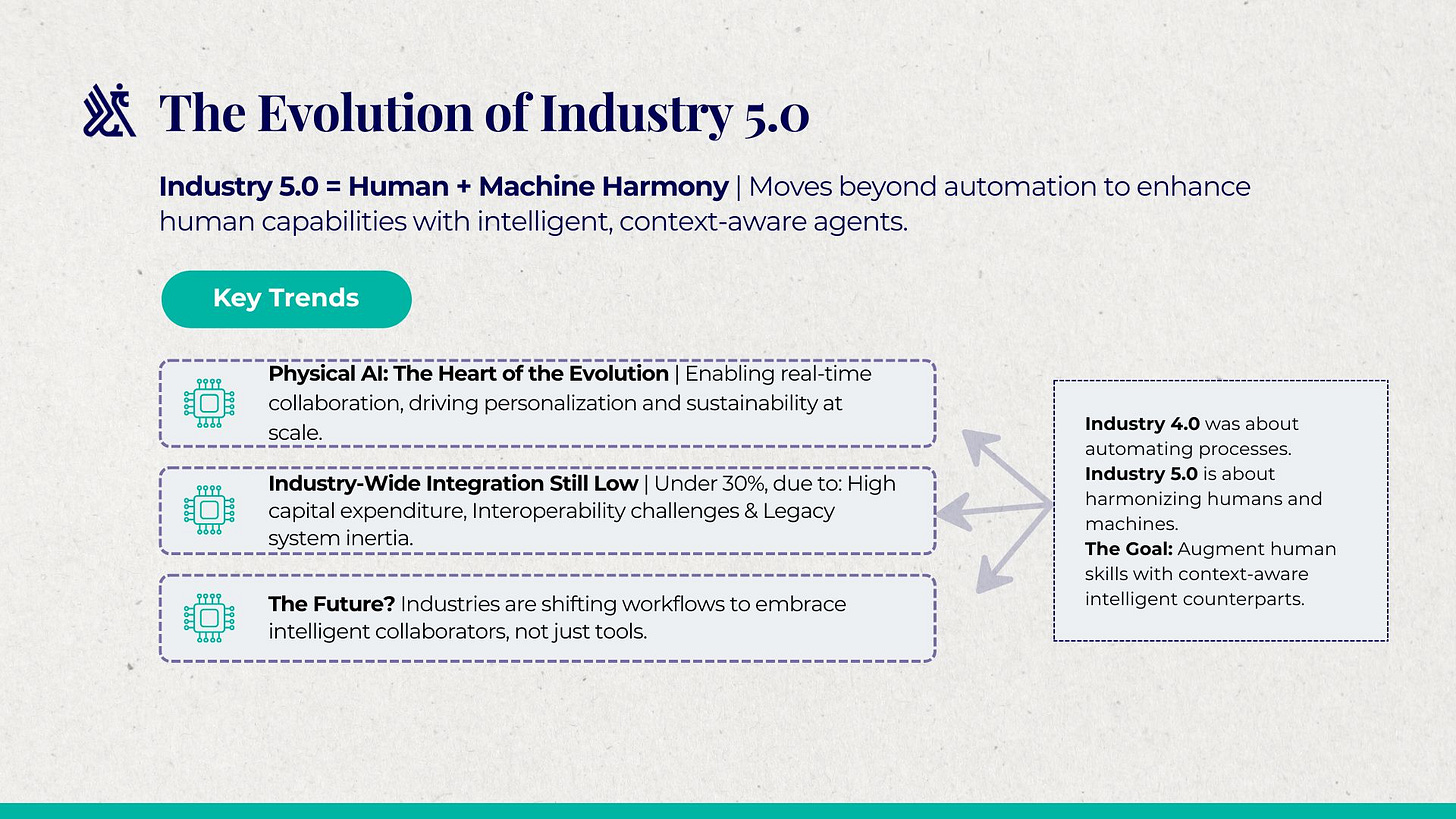

The Evolution of Industry 5.0

While the vision of Industry 4.0 focused on automating systems and processes, Industry 5.0 pivots towards harmonising machines and humans, i.e. augmenting human skills with intelligent counterparts that are context-aware and responsive. Physical AI is central to this evolution, enabling real-time human-machine collaboration and opening up possibilities for personalisation and sustainability at scale.

Yet, industry-wide integration remains below 30%, held back by challenges such as high capital expenditure, interoperability concerns, and the inertia of legacy systems. Nonetheless, the direction is clear: industries are reimagining workflows around intelligent agents that are not just tools but collaborators.

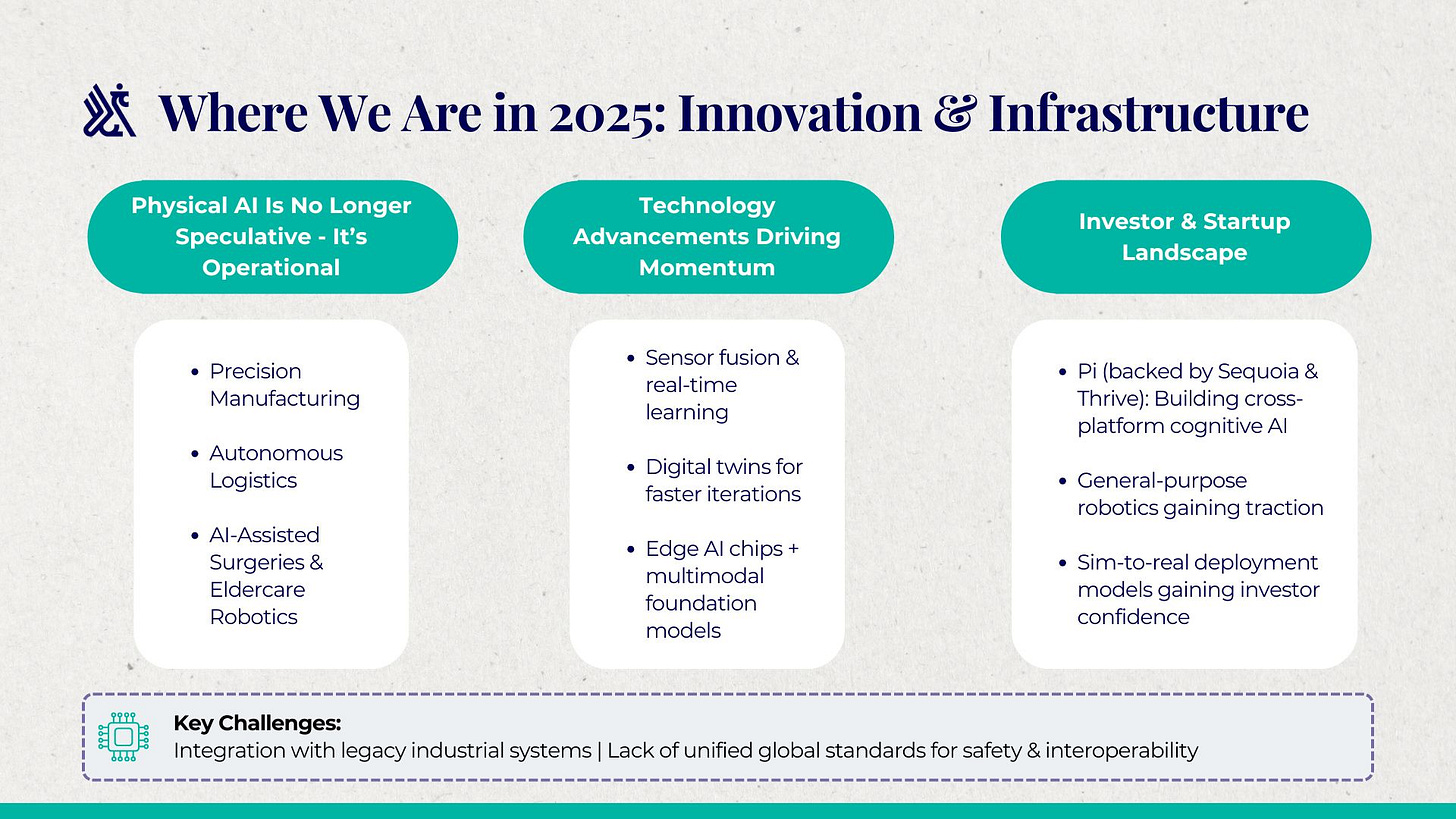

Where We Are in 2025?

Innovation and Infrastructure

Today, Physical AI is making its presence felt across several high-impact sectors. From precision manufacturing and autonomous logistics to AI-powered surgical assistance and eldercare robots, the technology is no longer speculative, it is operational. Innovations in sensor fusion, real-time learning, and digital twin technology are equipping machines with an unprecedented ability to adapt to dynamic environments. Advanced economies such as the USA, Germany, Japan, and South Korea are leading the charge, but emerging regions like India and Southeast Asia are rapidly advancing, thanks to localized innovation and cost-efficient solutions.

Sequoia Capital and Thrive Capital’s investment in Physical Intelligence (Pi) reflects the industry’s shift toward versatile, cross-platform AI. Pi’s mission to develop adaptable AI software that operates reliably in unpredictable real-world settings resonates with a broader industry goal: building general-purpose robotics that do not require extensive reprogramming for each new task. This is a decisive step forward in addressing the unpredictability that has long hindered robotic adoption.

On the technical front, Physical AI is engendering multiple advancements. Integration of control theory with advanced perception models, edge AI chips capable of real-time inferencing, and foundation models trained on multimodal data are pushing the boundaries of what robots can perceive and do. Digital twin technologies are accelerating development cycles, allowing developers to simulate and iterate before physical deployment. Still, challenges persist, particularly in achieving seamless integration with existing industrial ecosystems and in developing global standards that ensure safety, transparency, and interoperability.

Adoption across the Ecosystem

Specialised processors are becoming the nervous system of physical AI systems, enabling machines to perceive and interact with the physical world. Three chip types are spearheading this transformation—AI accelerators for high-intensity neural network processing, such as NVIDIA's automotive chips; edge AI chips enabling real-time, low-power decision-making on the factory floor, like those used in Texas Instruments' industrial robots; and neuromorphic chips, which replicate biological efficiency as seen in Intel’s smart sensors.

The automotive sector is leading the pace of adoption, with demand for autonomous vehicle training chips rising 45% annually. Tesla’s custom Dojo chips, a notable example, process a staggering 1 billion miles of driving data every week. In manufacturing, edge AI penetration has reached 62% in quality control, with Foxconn reducing defect rates by 38% through vision processors that analyse 500 parts per minute.

As a result, governments are bolstering momentum with strategic investments—India has committed $2.1 billion under its semiconductor mission to accelerate edge AI development, while the EU is backing neuromorphic research targeting human-brain efficiency in industrial robotics. Meanwhile, private sector players like NVIDIA now power 89% of global AI training infrastructure, processing sensor data for 80% of all autonomous vehicles. Amazon has also operationalised the shift, deploying warehouse robots with custom chips capable of making 1,200 inventory decisions per second at 85% less power consumption.

While the progress so far is notable, supply is still an issue. Developing custom chips takes over 14 months, and 68% of enterprises report deployment delays due to ongoing supply chain disruptions.

Still, with the physical AI chip market projected to triple to $311 billion by 2029, these processors are steadily becoming the cornerstone of intelligent infrastructure worldwide.

Policymakers are beginning to recognise the urgency of enabling this shift. In the United States, the transition from the National Robotics Initiative to a broader AI strategy was formalised through the creation of the National Artificial Intelligence Advisory Committee and the issuance of the NIST AI Risk Management Framework. Executive Order 14179 in 2025 further cemented the country’s commitment to AI leadership. Industry bodies such as A3 have amplified this momentum, calling for a centralised robotics office and tax incentives to spur adoption. However, many of these frameworks still focus predominantly on digital AI risks, leaving a gap in policies that directly address the physical and operational safety implications of embodied AI.

The private sector is also mobilising at scale. The Stargate Project, announced in early 2025, is a striking example of capital commitment to the future of intelligent infrastructure. Backed by OpenAI, SoftBank, Oracle, and MGX, the initiative promises up to USD 500 billion in investment across data centers and AI capabilities by 2029, underscoring the long-term belief in AI as a foundational technology that reshapes labor, productivity, and national competitiveness.

Technology leaders are playing a critical role in shaping this future. NVIDIA has emerged ahead in simulation and robotics training through its Omniverse and Isaac Sim platforms, and its recently unveiled Project GR00T is redefining how developers build and train humanoid agents. Siemens is driving industrial AI through its Xcelerator platform, integrating intelligent automation with high-fidelity simulation. Established players like Boston Dynamics and ABB continue to push the envelope in robotics hardware, while startups such as Agility Robotics and Figure AI are designing bipedal machines capable of functioning effectively in human-centric spaces.

In India, the startup ecosystem is embracing the Physical AI movement with remarkable agility. From Asimov Robotics’ humanoid assistants to Ati Motors’ autonomous EVs and Genrobotics’ sanitation solutions, these companies exemplify how frugal innovation and contextual design can unlock meaningful impact. Their work is not only addressing domestic needs but is also setting the stage for India to emerge as a serious contender in the global Physical AI race.

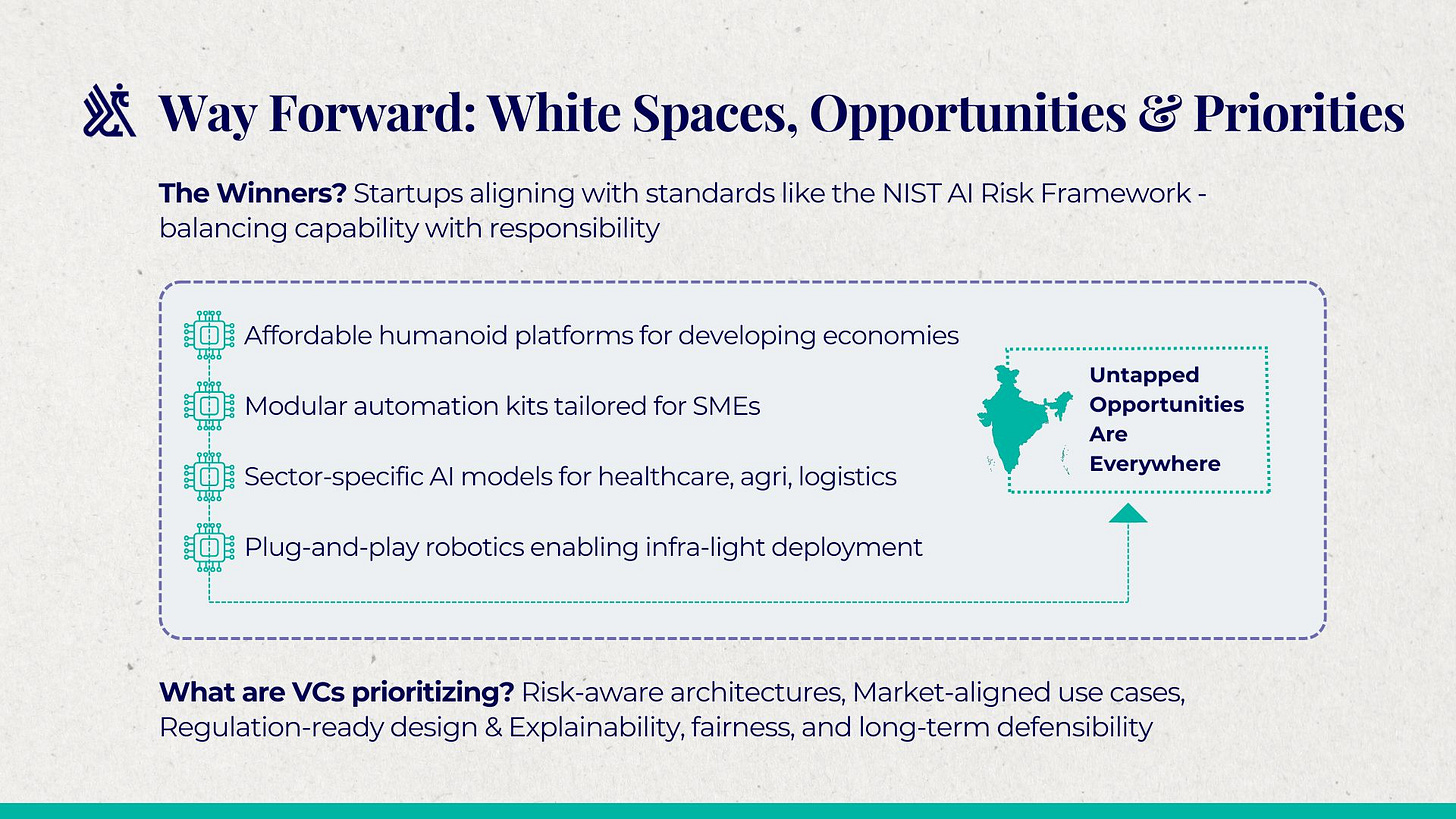

The Way Forward: White Spaces, Opportunities, and VC Priorities

The road ahead is ripe with untapped opportunity. Affordable humanoid platforms for developing economies, modular automation kits for SMEs, AI-driven maintenance and self-repair capabilities, and foundational models tailored to specific sectors like healthcare, agriculture, and logistics offer fertile ground for the next wave of disruption. The shift toward plug-and-play robotics and infrastructure-light deployment will further democratize access to Physical AI.

From a venture capital perspective, the focus is increasingly on startups that balance cutting-edge capability with responsible innovation. Risk-aware architectures, market-aligned solutions, regulation-readiness, and frameworks rooted in explainability and fairness are no longer optional, they are prerequisites for long-term success. Startups that proactively align with evolving standards, such as the NIST AI Risk Management Framework, are well-positioned to command premium valuations and build enduring value.

Conclusion: From Science Fiction to Industrial Reality

What was once seen as science fiction is fast becoming industrial reality. Physical AI is not merely an add-on to existing systems, it is reshaping the very architecture of how work is designed, performed, and scaled. As we look towards Industry 5.0, the convergence of cognitive robotics, biological interfaces, and sustainable systems may redefine not just productivity, but the very nature of human-machine coexistence. The transition from automation to augmentation is already underway, and Physical AI is the compass guiding us into a more intelligent, inclusive, and deeply embodied future.

If you are looking to build in this space, we would love to chat! Please reach out to us at pitches@eximiusvc.com.