The Evolution of Peer-to-Peer (P2P) Insurance in India

Exploring the transformative potential of P2P insurance in India’s evolving insurance landscape.

Hi there!

This week on Eximius Echo, we dive into the innovative world of Peer-to-Peer (P2P) insurance and its growing impact on the Indian insurance sector. P2P insurance is reshaping how insurance is perceived and executed, fostering a collaborative, community-driven approach that promises to make insurance more transparent, affordable, and aligned with the interests of policyholders. While still nascent in India, P2P insurance has significant potential to flourish, provided the regulatory environment supports its growth.

If you’ve not heard of us, Eximius is a pre-seed stage fund focusing on FinTech, SaaS, Online Media & Gaming, and HealthTech. You can find out more here. This newsletter is an attempt to share ideas, insights, and context within the realms of our chosen sectors. Let’s dive in.

The Emergence of P2P Insurance in India

P2P insurance represents a novel approach where individuals band together to insure each other. This model leverages community trust and shared interests to provide coverage, often resulting in lower costs and enhanced customer satisfaction. Unlike traditional insurance, which operates on a profit-driven model, P2P insurance emphasises mutual aid among its members, redistributing unused premiums to policyholders or reinvesting them to lower future premiums.

How P2P Insurance Works

In India, risk-pooling can trace its roots back to Chit Funds — a rotating savings and credit association (ROSCA) scheme legislated under the Chit Fund Act of 1982.

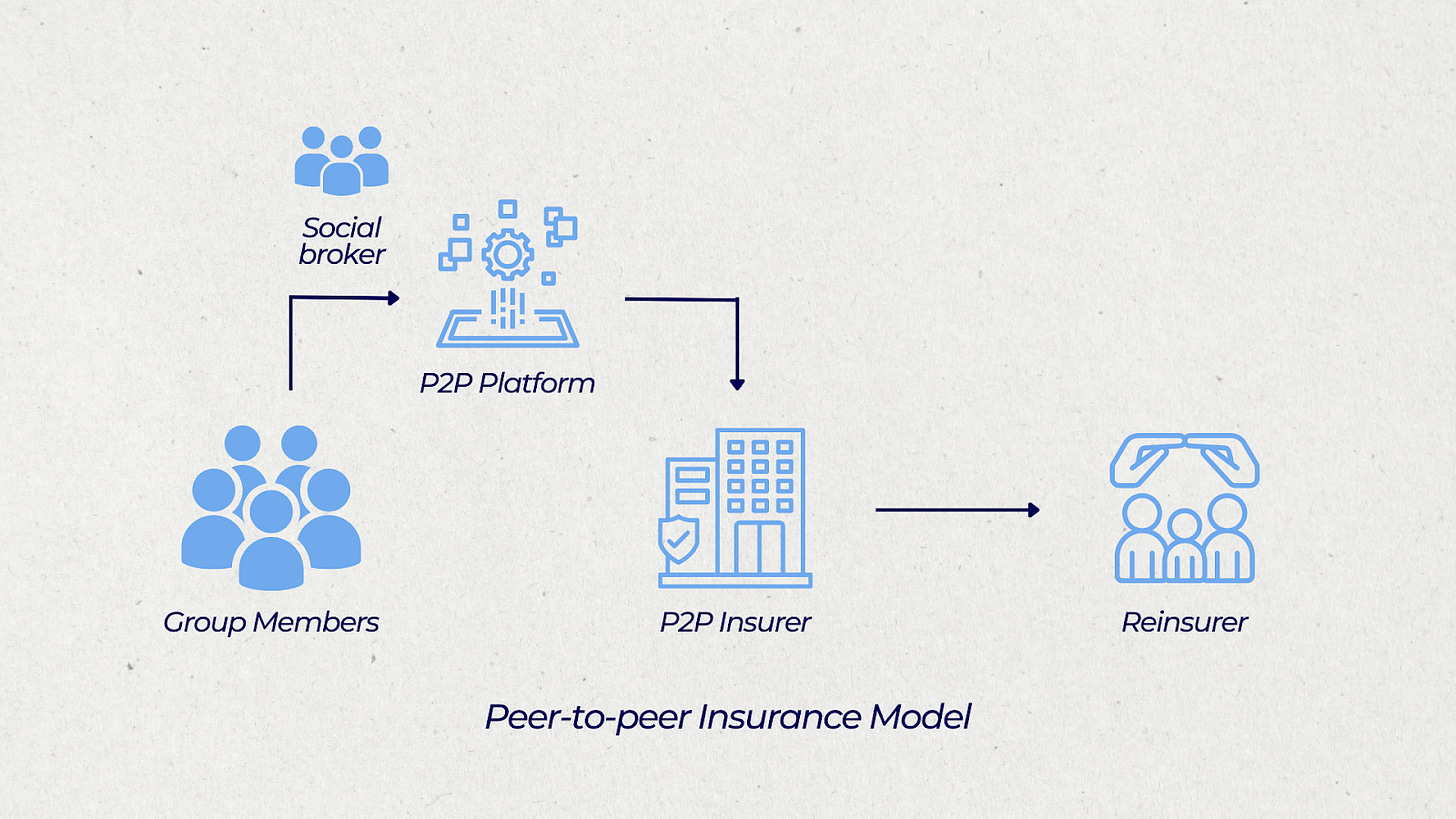

At its core, P2P insurance also involves forming small groups of individuals who pay premiums into a collective pool. When a member files a claim, the funds are drawn from this pool. If the pool funds are insufficient, a reinsurance policy covers the shortfall. This model fosters transparency and trust, as members are likelier to adhere to honesty, knowing that false claims would affect the entire group.

The Indian Context: Rising Adoption and Potential

India, with its vast population, community-driven culture, and growing digital infrastructure, presents fertile ground for P2P insurance. Traditional models often fail to serve diverse and underserved segments, resulting in low insurance penetration. P2P insurance can bridge this gap by offering tailored products for specific community needs, such as health, life, motor, and crop insurance. In a country where insurance claims are inconsistent and trust is low, P2P insurance’s transparent and collaborative approach can restore confidence and meet the unique needs of Indian policyholders.

Regulatory Landscape

The Insurance Regulatory and Development Authority of India (IRDAI) has been proactive in embracing innovation. While specific regulations for P2P insurance are still evolving, the regulatory body’s supportive stance towards FinTech and InsurTech innovations provides a conducive environment for P2P insurance to flourish. P2P platforms must navigate these regulations carefully to ensure compliance and build consumer trust.

Key Players and Initiatives

Several innovative startups are leading the charge in India’s P2P insurance space. Companies like Toffee Insurance and Turtlemint are experimenting with community-based insurance models, leveraging technology to streamline operations and enhance user experience. These platforms utilise data analytics and AI to assess risk more accurately and tailor products to meet the needs of specific user groups.

Globally, Friendsurance (Germany and Australia) offers cashback bonuses for claim-free years, while New Zealand's PeerCover fosters cooperative risk-sharing. In the UK, Bought By Many (now ManyPets) revolutionises pet insurance by negotiating better terms for specific groups. insPeer (France) helps individuals share insurance deductibles. Russia's Teambrella enhances transparency with claims approved by team consensus. New York-based Lemonade uses AI to streamline processes and donates leftover premiums to social causes.

Benefits of P2P Insurance

Affordability and Efficiency: One of the most significant advantages of P2P insurance is its cost-effectiveness. By eliminating intermediaries and distributing risk among participants, P2P insurance can offer lower premiums than traditional insurance. This efficiency is further enhanced by the use of digital platforms that streamline operations and reduce administrative costs.

Transparency and Trust: P2P insurance platforms often incorporate blockchain technology to ensure transparency and build trust among participants. Every transaction and claim is recorded on an immutable ledger, making it easy to verify and audit. This transparency helps prevent fraud and fosters a sense of community and trust among group members.

Customisation and Flexibility: P2P insurance allows for greater customisation to meet the specific needs of different groups. Whether it's a community of freelancers seeking health insurance or a neighbourhood pooling resources for disaster coverage, P2P insurance can be tailored to provide relevant and adequate protection.

Challenges and Opportunities

While P2P insurance presents numerous benefits, it also faces challenges that need to be addressed to realise its full potential in India.

Regulatory Uncertainty: Navigating the regulatory landscape is one of the primary challenges for P2P insurance in India. Ensuring compliance with existing insurance regulations while advocating for new frameworks that accommodate P2P models is crucial for the industry's growth. Collaborative efforts between industry stakeholders and regulators will be vital in overcoming these hurdles.

Trust and Adoption: For P2P insurance to succeed, it must build awareness and trust among potential participants. Educating the public about the benefits and mechanisms of P2P insurance and showcasing successful case studies will help foster adoption and acceptance.

Technology and Security: The success of P2P insurance relies heavily on robust technological infrastructure. Ensuring the security and privacy of participants' data is paramount. Investing in advanced cybersecurity measures and continuously upgrading technology platforms will be essential to maintaining trust and reliability.

The Road Ahead

The future of P2P insurance in India looks promising. As digital literacy increases and more people gain access to smartphones and the internet, the reach of P2P insurance is set to expand. Continued regulatory support, coupled with technological advancements, will play a pivotal role in shaping this innovative insurance model.

In conclusion, P2P insurance holds the potential to revolutionise the insurance sector in India by fostering inclusivity, reducing costs, and enhancing transparency. While challenges remain, the growing interest and investment in this space signal a bright future. We look forward to seeing more startups and innovations that harness the power of community to redefine insurance.

If you're an entrepreneur building in this space, we would love to hear from you. Please write to us at pitches@eximiusvc.com with your ideas.