WealthTech in India - Going beyond the 1%

India's WealthTech sector is currently at an inflection point, having seen rapid growth fuelled by policy reforms, tech adoption, and demographic shifts.

Hi there!

This week on Eximius Echo, we dive into a quiet revolution transforming India's financial landscape: the rapid evolution of WealthTech beyond the top 1%. Once seen as tools for the ultra-wealthy, tech-driven wealth management is now powering the ambitions of India's expanding middle and mid-affluent classes.

Fuelled by rising incomes, digital inclusion, and a new wave of financial literacy, WealthTech is shifting from a niche solution to a mass-market phenomenon. From DIY investing apps to hyper-personalised advisory platforms, the industry is reshaping how young Indians plan, save, and grow their wealth—with convenience, accessibility, and goal-based planning at the forefront.

If you’re new here, Eximius is a pre-seed VC fund backing bold ideas in fintech, AI/SaaS, and consumer tech. We use this newsletter to share insights, trends, and ideas from the sectors we’re passionate about. Let’s dive in.

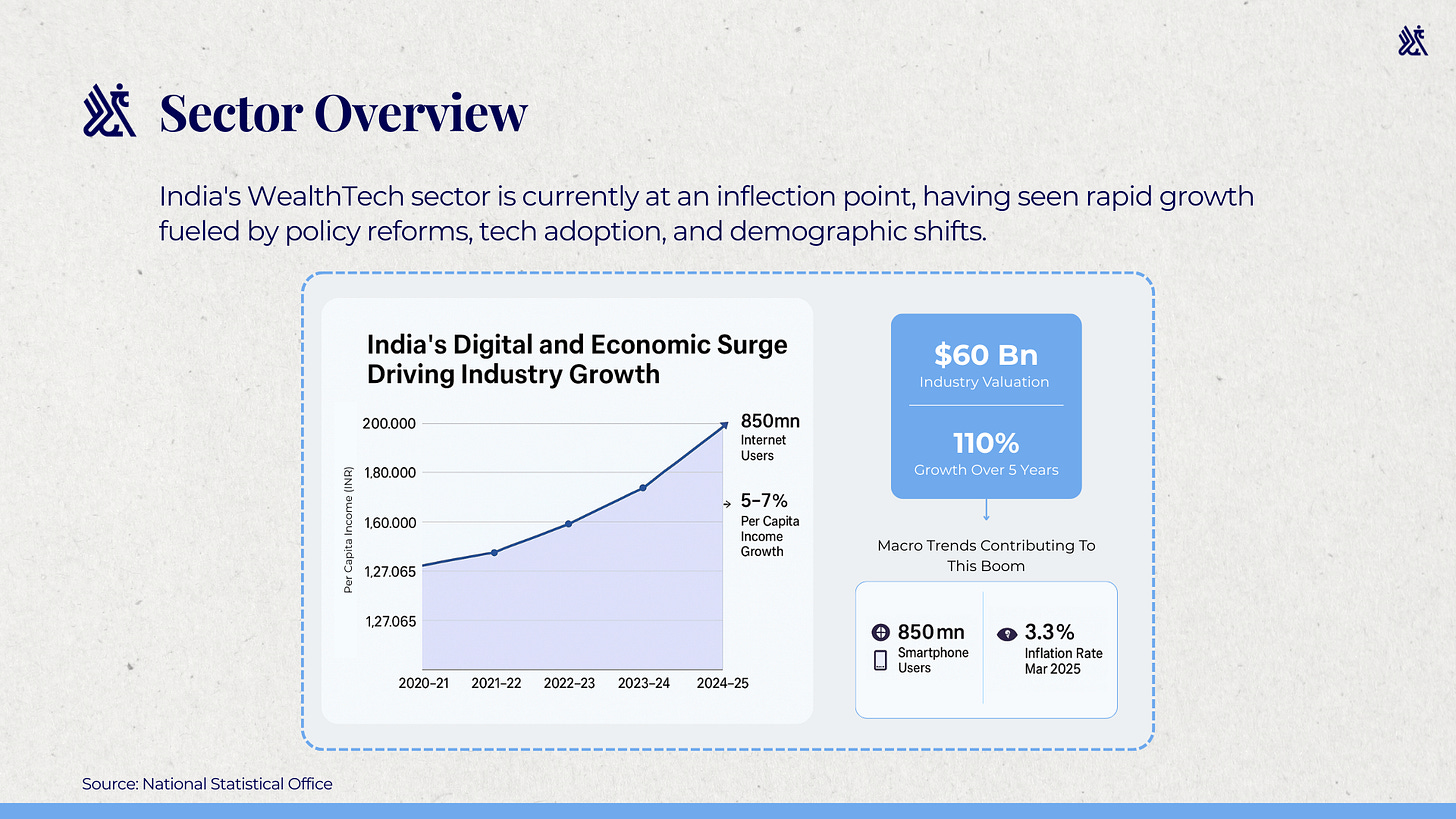

India's WealthTech sector is currently at an inflection point, having seen rapid growth fuelled by policy reforms, tech adoption, and demographic shifts.

Valued at over $60bn currently, the industry has seen a 110% growth in just five years. Several macro trends are contributing to this boom. First, digital inclusion is accelerating - India has over 850mn internet users and more than 750mn smartphone users. As shown in the chart below, India’s per capita income has increased from INR 1,27,065 in 2020-21 to INR 1,96,178 in 2024-25 per data sourced from the National Statistical Office, and is projected to continue growing at an annual rate of 5-7%. As of March 2025, India’s inflation rate stands at 3.3%, thus showing that the growth in per-capita income is beating inflation rates as well

.

This rise in disposable income, coupled with strong public infrastructure in terms of Aadhar, Account Aggregator, etc., have laid a solid foundation for digital finance. For instance, UPI alone clocked 13 billion transactions in 2024, up from just 1 billion in 2019.

Moreover, the country’s middle class population (defined to be households with an annual income between INR 5 lakh to INR 30 lakh) has seen an exponential growth over the last 5 years - growing from 432mn in 2020-21 to 570mn (projected) in 2024-25 - and is expected to form around 50% of the country’s overall population by 2030.

This population is now actively looking for smarter financial tools owing to higher disposable income from macro events such as the startup boom, strong public market run, and increased awareness of financial instruments. In a country where less than 5% of the population currently invests in equity markets - vs. 55% in the US - the potential is enormous for WealthTech to be the next big disruptor in the FinTech space.

Middle class driving the next phase of WealthTech growth

The mid-affluent segment - households earning INR10-50 lakh annually - has been the major driver of WealthTech’s growth in India. There are over 30mn such households in urban India, growing at a CAGR of 10% YOY. Key factors behind this increased adoption of WealthTech include:

● Growing Financial Awareness: A 2023 SEBI survey showed that over 65% of millennials in urban India consume at least one form of financial content monthly. YouTube finance channels and online influencers audience.

● Shift from Physical to Digital Assets: Between 2020 and 2023, India saw a 200% growth in mutual fund SIP accounts, rising from 2.6cr. to over 8cr.. Retail investors now contribute over 25% of all mutual fund assets, reflecting a preference shift.

● Need for Goal-Based Planning: Surveys by ETMoney show that over 60% of mid-income users set financial goals for children’s education, home purchases, or retirement. If we look at global parallels, almost 83% of US teenagers have claimed to understand or work towards retirement-planning.

● Technological Advancements: India Stack, UPI, DigiLocker, and e-KYC have made onboarding and compliance frictionless. With digital public infrastructure scaling, trust in digital platforms has jumped significantly.

● Under-Advised Yet Invested: Only 1 in 10 Indians use a financial advisor. This gap is particularly pronounced among the mid-affluent, who have enough to invest but lack access to tailored advice. WealthTech has the potential to automate and personalise this process to include the mid-affluent to a larger degree.

Key new-age WealthTech segments in India

● Discount Broking: Discount broking has seen some of the biggest success stories in the Wealth Management space in India - driven by behemoths such as Zerodha and Groww. User-friendly platforms, competitive pricing, and an emphasis on tech-stack have allowed discounting brokers to improve their market-share within the broking industry from 11% in 2018 to over 60% today.

Zerodha: With over 12 million users, it is India’s largest stockbroker by active clients. Zerodha has also actively worked on diversification of offerings, with its Coin platform attracting over INR 1,800cr. in mutual fund assets. Zerodha’s focus on investor education makes it especially appealing to DIY investors.

Groww: Groww has over 10mn active users today. Its mobile-first product and easy-to-use UI/UX has helped it penetrate Tier 2 and Tier 3 cities, where 40% of its user base now resides.

● ETFs: ETF trading volumes have grown from INR 26,139cr. in 2017 to INR 183676cr. in 2024, with ETFs today forming 13% of the mutual fund industry’s overall AUM. Affordability and ease-of-use have once again been the key drivers of growth, with players such as Smallcase targeting the mid and mid-affluent segments successfully.

Smallcase: Smallcase offers curated portfolios of stocks and ETFs that cater to specific themes per each investor’s requirements. Over the last five years, its user base has expanded from 1.5 lakh to 1.5cr., with cumulative transactions crossing INR 80,000cr. in 2024.

● Stock Advisory: Stock advisory has been the newest success story in the WealthTech space. While financial advisories and influencers have always been in the market, tech-enabled digital platforms such as Liquide and Univest, that offer consistent, reliable information have seen high adoption rates in the market - this includes both players offering standard stock research & analysis, and companies that offer trade recommendations on commodities to retail investors.

Univest: Univest offers AI-driven stock advisory and has recently expanded to include full-stack brokerage services as well. Within 2 years, Univest has amassed over 3 million users and sold over 1,50,000 subscriptions, with annual revenues today exceeding INR 60cr.

● Portfolio / Wealth Advisory: The growth in income levels have also directly resulted in an increased need for portfolio management services. The number of PMS clients reached 3.3 lakh in 2024, with this figure having grown by 10% over 2023. Similarly, the PMS industry's AUM grew from INR 27.74 lakh crore in 2023 to INR 33.65 lakh crore in 2024. However, PMS has also been an industry that has largely left the mid-affluent segment uncovered - much of the industry’s growth has come via HNIs and UHNIs investing in this space. With macro elements offering tailwinds for the mid-affluent segment, the opportunity is ripe for wealth advisory players to cater to this segment.

Dezerv: Dezerv offers personalized investment strategies across equities, fixed income, and alternative assets to HNIs and UHNIs. Its AUM has grown from INR 1,000cr. in 2022 to over INR 10,000cr in 2024, highlighting the significant growth seen in this industry in recent times.

White Spaces - What’s Missing?

While the Indian WealthTech space has seen rapid growth and an influx of tech-led solutions that have opened new markets, there are still multiple open spaces for new-age companies to build in:

● Hyper-personalised advisory: Digital, AI-driven financial planning tools that adapt to life stages, risk profiles, and income fluctuations are still rare. With the India-stack now offering improved financial information, tools such as Account Aggregator can be used to adapt to individual incomes on a periodic basis and offer goal-based plans according to the same. Dynamic customisation of advice upon consideration of each individual’s profile, goals, and risk appetite could see large-scale adoption among the mid-affluent.

● Transparent and affordable-pricing: Current wealth management firms have either limited themselves to HNIs and above, or charge 1% or more of the AUM, effectively pricing-out the mid-income segment. Subscription-based models that offer financial advice at reasonable prices could be the key to opening the market up for this segment.

● Alternative Assets: Platforms for investing in REITs, green bonds, fractional investments, etc., are fragmented or inaccessible. Opening up new modes and instruments of investments can play a major role in attracting the younger population towards instruments such as bond investments, which have seen high interest among the newer investors.

● Advisory for NRIs and Global Access: India has over 32mn NRIs, yet very few platforms offer efficient onboarding, repatriation services, or global investing opportunities. With the government pioneering avenues such as GIFT City to improve ease-of-access for overseas investors, platforms could look to leverage the same to digitise and enable higher volumes of transactions in this segment.

Conclusion

UHNIs and HNIs have typically been the most targeted segment for wealth management services, owing to their high propensity to invest. However, this is also a segment that is currently being catered to by a multitude of companies - old and new.

Parallelly, India’s mid-affluent class is digitally native and increasingly investment-savvy; however, they remain underserved by tech-led solutions that are priced at reasonable levels. With more than 65% of India’s population under the age of 35 and average urban household incomes projected to grow at 8.1% annually till 2030, the demand for accessible, intuitive, and goal-based investment tools is at an all-time high.

The median age of Indian investors is just 28, and over 70% of new investors in 2024 came from Tier 2 and Tier 3 cities according to NSE data. To win in this market, WealthTech players must go beyond commoditised product offerings. Platforms that can integrate financial education, community-based investing, and life-stage tailored advisory will emerge as the next big winners in this industry.

If you are looking to build in this space, we would love to chat! Please reach out to us at pitches@eximiusvc.com.