When AI Met Commerce

Why the next generation of marketplaces will be built around intent, not inventory.

This week on Eximius Echo, we’re unpacking the next structural shift in commerce: the move from inventory-led marketplaces to intent-led, AI-native shopping experiences.

For decades, commerce scaled by expanding catalogs, optimizing search, and pushing traffic through increasingly crowded funnels. Mobile improved convenience, but discovery, trust, and decision-making remained fragmented. Today, AI is beginning to change that foundation - not by showing consumers more products, but by understanding intent, collapsing discovery time, and actively guiding decisions.

This shift is redefining how demand is created, how supply is surfaced, and where value accrues. The winners won’t be those with the largest inventory, but those that own decision-making at the moment of intent.

If you’re new here, Eximius is a Pre-seed VC fund backing bold ideas in FinTech, ConsumerTech, and Enterprise AI. We use this newsletter to share insights, trends, and ideas from the sectors we’re passionate about. Let’s dive in.

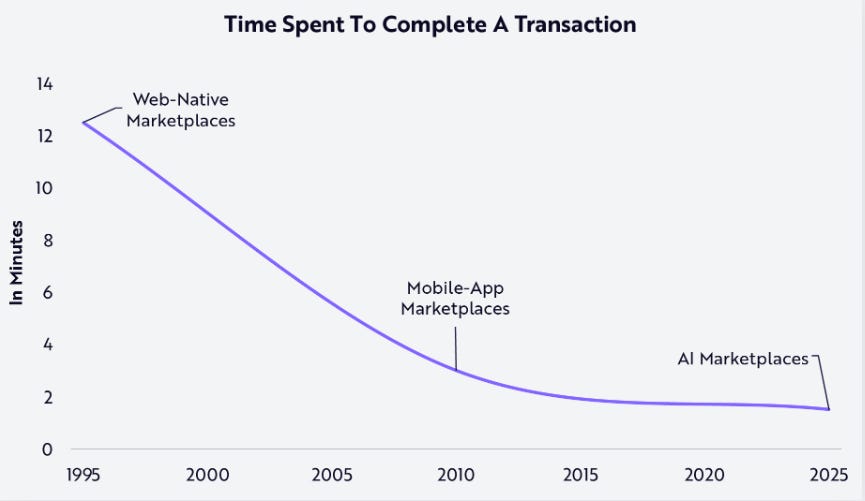

Marketplaces have always evolved in tandem with technology to reduce friction in the discovery and purchase of goods. Currency replaced barter, department stores introduced standardised pricing and trust, global supply chains unlocked scale, and the internet removed geographic constraints. Mobile commerce then reset expectations around speed, convenience, and infinite choice.

Across each wave, marketplaces consistently optimised four core levers: discovery, pricing, inventory, and fulfilment.

Today, the next inflection point is AI. Commerce is beginning to shift from search-led, manual browsing toward intelligent, agent-driven shopping.

The Shape of India’s Commerce Opportunity

India is one of the world’s largest consumption markets. Online retail stands at roughly $70B (~10% of total retail) and is growing at ~20% YoY, driven by three structural tailwinds:

a 300M+ online shopper base,

deeper Tier-2+ penetration (already ~60% of incremental demand), and

rising purchase frequency as grocery, fashion, and beauty move online.

Fashion (~30%) is among the fastest-growing large categories, fueled by trend-led demand and rising online comfort.

Within online fashion, GMV and volumes are sharply skewed by price tier. Mass fashion drives ~50% of GMV but ~75% of volumes (low AOV, high commoditization). Aspirational fashion contributes ~35% of GMV with ~20% of volumes, while premium accounts for ~15% of GMV on just ~5% of volumes. This skew highlights a critical insight: future GMV and margin expansion will be driven by curation, trust, and fit, not traffic scale alone.

From Browsing to Buying: The Rise of Intent-Led Consumer Behaviour

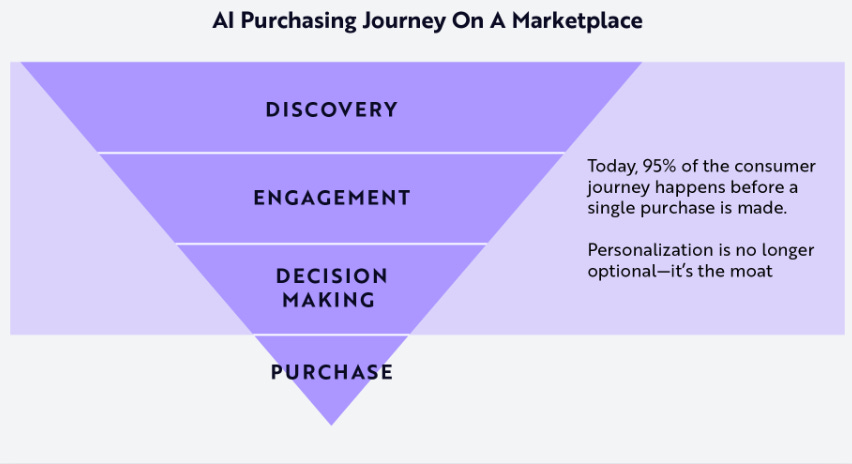

Consumer behaviour in commerce is shifting from exploration-heavy, search-led journeys to faster, influence-driven, and increasingly assisted decision-making.

Discovery time is collapsing as intent per session rises: Average fashion e-commerce journeys have compressed from ~20-30 minutes per purchase to ~8-12 minutes, while recommendation-led sessions convert 1.5-2.0× better than search-only flows.

Social and video are replacing search as the primary discovery layer: Around 30-40% of Gen Z and millennial shoppers now discover products via short-form video (Instagram Reels, YouTube Shorts) before ever searching. Social-influenced purchases account for ~15-20% of online GMV.

Assisted shopping is scaling faster than expected: Roughly 25-35% of online shoppers have used some form of AI assistance (chat, recommendations, size guidance). Conversational interfaces deliver 10-20% higher conversion rates and 5-10% lower returns compared to traditional flows.

Convenience and price sensitivity now coexist: Consumers are willing to pay a 5-10% premium for faster delivery or higher confidence (fit, authenticity), even as price comparison shifts earlier in the journey, compressing brand differentiation at checkout.

Where Today’s Marketplaces Break Down

Fashion discovery isn’t broken because of lack of choice, it’s broken because of lack of confidence, context, and clarity. Discovery is fragmented across Instagram, influencers, and offline cues, while checkout, trust, and fulfillment remain anchored to legacy marketplaces.

At scale, this fragmentation compounds:

Discovery fails to convert intent: Marketplaces host millions of SKUs, yet ~5% of inventory drives ~80% of GMV. Mass users face price clutter, aspirational shoppers struggle to find differentiated brands, and premium users can’t easily discover niche labels - leading to weak intent capture and inefficient CAC.

Fit, returns, and trust erode unit economics: Fashion return rates of ~25-40%, driven by poor fit and expectation mismatch, inflate logistics costs and compress margins. Premium buyers also demand authenticity, sizing confidence, and service quality that horizontal marketplaces struggle to deliver consistently.

Personalization remains shallow: Despite vast data pools, recommendations are largely rules-based and non-contextual. Assortment skews toward commoditized SKUs, while long-tail niches remain underserved - lowering conversion and weakening repeat behaviour.

Demand Is Fragmenting, Not Scaling Uniformly

Fashion spend is shifting toward micro-segments rather than broad categories. Athleisure and casualwear are growing at ~18-20% CAGR, value sneakers show 2× higher online penetration than apparel, and D2C premium fashion is compounding at 25%+, driven by design, drops, and brand affinity rather than discounts.

At the same time, SKU scale on marketplaces has far outpaced usable depth. Leading marketplaces list 1-5M+ fashion SKUs, yet fewer than 10-15% of brands capture meaningful demand, signalling chronic oversupply in commoditized price bands and persistent undersupply in curated niches.

How Marketplaces Will Evolve

Incumbent platforms like Amazon, Flipkart, and Myntra will evolve into AI-enabled marketplaces, not AI-native ones. AI will be layered aggressively to optimize existing systems rather than re-architect how commerce fundamentally works.

What changes:

AI materially improves search relevance, recommendations, pricing, inventory turns, return prediction, and logistics efficiency.

Friction across the funnel drops, lowering CAC and lifting conversion.

Unit economics expand through better demand forecasting and faster inventory cycles.

What doesn’t change:

Discovery remains SKU-led and reactive to intent, anchored in search, filters, and comparison.

Supply stays catalog-first and scale-biased, optimized for GMV, margins, and sponsored placement.

Long-tail and emerging brands continue to face cold-start problems, limited visibility, and pay-to-play discovery.

AI-Native Marketplaces Create New Demand

AI-native marketplaces are built around intelligence, not inventory. The AI layer is not an enhancement to the product-it is the product. Remove the AI, and the marketplace stops functioning.

What fundamentally changes:

Discovery shifts from browsing to intent expression. Users communicate mood, occasion, context, or taste, while AI interprets soft signals such as lifestyle, aesthetics, and social behavior.

Catalogs become dynamic. Static brand listings give way to algorithmically assembled assortments - looks, edits, capsules, or personalized drops generated in real time.

Discovery becomes proactive. Instead of reacting to search queries, AI surfaces “this fits you now,” moving from brand-led merchandising to user-led taste graphs.

How AI-Driven Shopping Will Look

AI is reshaping commerce end-to-end, from discovery to creation to checkout. The core shift is from browsing products to delegating decisions to intelligent systems.

Fit and confidence move pre-purchase. Visual try-ons, AR, and AI avatars answer “will this suit me?” before checkout. As 3D body and fabric modeling improve, uncertainty drops and return rates fall.

Outcomes replace products. AI stylists and digital closets recommend complete looks, not single items, using wardrobe data, context, and lifestyle signals. Commerce shifts from selling SKUs to solving occasions.

Discovery becomes conversational and visual. Search moves from keywords to intent. Users describe, show, or reference what they want, and AI curates options across brands, budgets, and constraints - compressing decision time.

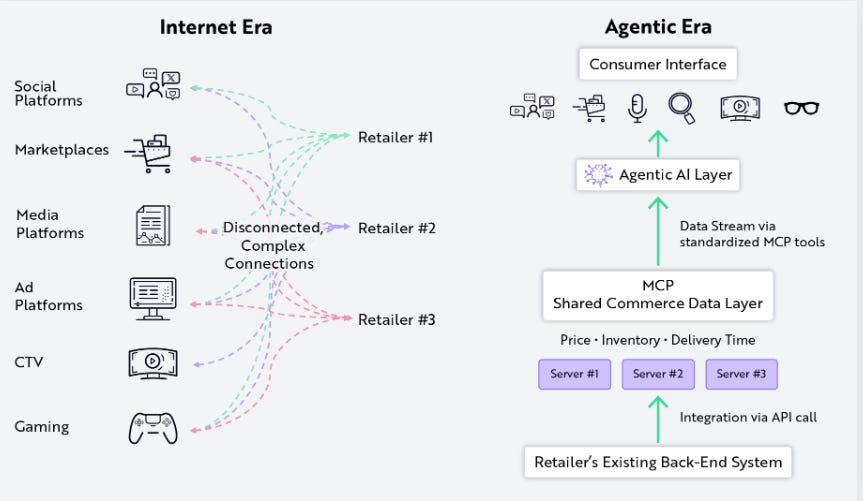

Supply, pricing, and execution become agentic. Generative AI enables on-demand design and rapid prototyping, while autonomous agents predict demand, optimize inventory, surface deals, and complete checkout across platforms.

Whitespaces to Build In

India’s AI commerce stack is taking shape rapidly - from backend optimization to shopper-facing experiences - while incumbents embed AI across search, payments, and checkout. The next wave will be less about incremental features and more about who owns the agentic layer.

Conversational commerce: Over 70% of India’s online shoppers come from non-metro markets, where search and filters add friction. Voice- and chat-led shopping in regional languages offers a more intuitive path to discovery-led purchases.

Circular fashion and C2C resale enablement: Resale is gaining momentum as value-conscious consumers, high wardrobe churn, and social acceptance of thrift converge. AI can formalize this behavior through accurate item valuation, quality grading, and demand matching.

Unified commerce data: Even at scale, product data remains fragmented across sellers and channels. As AI increasingly guides purchasing decisions, standardized, real-time access to pricing, inventory, and delivery data becomes critical infrastructure.

Omnichannel intelligence: Physical touchpoints still influence a large share of fashion purchases. AI can bridge online preference data with store-level inventory via virtual try-ons, in-store kiosks, and scan-to-buy experiences.

From Inventory to Intent

The next phase of commerce will not be won by platforms that show more products, but by those that own decision-making. As AI shifts shopping from browsing to delegation, value moves upstream, from inventory aggregation to intent interpretation.

AI-enabled incumbents will optimize catalogs and logistics. AI-native marketplaces will do something more fundamental: reduce cognitive load, increase confidence, and deliver outcomes instead of options.

In a mobile-first, influence-led market like India, this transition will happen faster than expected. The real opportunity is not building another marketplace, but building the intelligence layer commerce runs on.

If you’re a founder building in this space, we’d love to chat. Reach out to us at pitches@eximiusvc.com

Brilliant insights! This whole idea of intent-led commerce is fascinating. It makes me wonder how long until AI truely predicts my next favorite book, not just based on what I've read, but what I *really* need. Mind-blowing stuff!